One of the largest issues that continues to plague banks and businesses is check fraud. Thanks to computers, thieves have become better equipped to create accurate-looking checks, and can easily swindle thousands of dollars from unsuspecting individuals. There are multiple ways that thieves can create a check. Some will counterfeit a check using a computer program while others will use chemical alterations on existing checks. The businesses that accept these checks often fall victim to check fraud problems and lose money. Financial institutions and consumers also can end up losing money due to check fraud. Here are the common methods criminals use when forging checks.

Forgery

Forgery is perpetrated against businesses quite frequently. An employee can get hold of the company’s checkbook and start writing checks to themselves, stealing money from the company. Criminals can create forged checks if they break into your home and steal your checkbook, or swipe it from your purse. When a person forges a check, they often use a fake identity to cash the check so financial institutions and individuals have a harder time tracing who the check was cashed by.

Counterfeiting

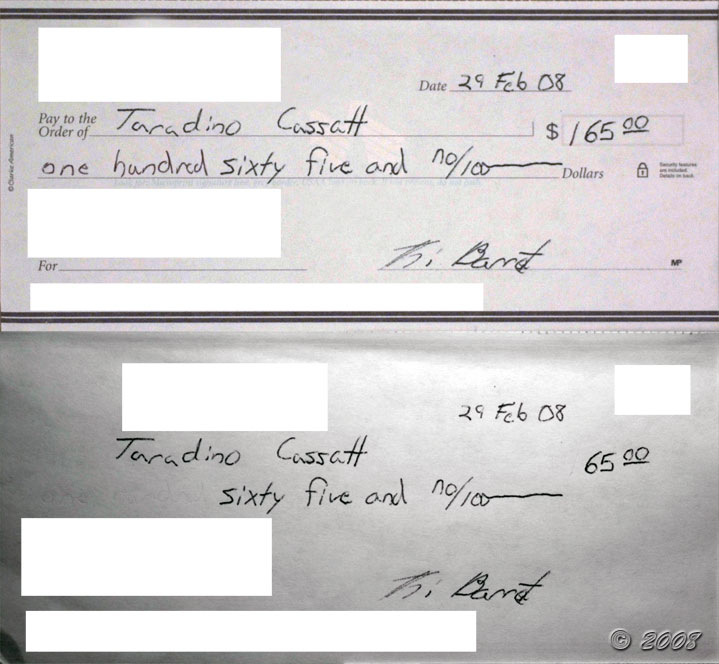

A criminal can create a counterfeit check with computer programs. They simply need to gain access to an account number, and then they can easily print out a check with a nice laser printer. Some criminals prefer older methods of counterfeiting and will actually alter a check. They will use acetone and other solvents to remove the information on the check and will then write out a new check to themselves in any amount they desire.

Paperhanging

If a person dies, it is easy for a criminal to find out what their account information is. They will often write checks on the closed accounts and will order new checks on the same account. They can go along cashing the checks at a number of places before the financial institution finds out someone is using a closed account.

Check Kiting

Check kiting is similar to the paperhanging method: a criminal will end up opening several accounts at multiple banks. They will use a float time of available funds to create fraudulent bank accounts and balances. Since there is a lot of pressure on banks to make deposits available quickly, it is easy for criminals to use the float time to cash large checks.

Protecting Yourself

Since bank fraud problems cost consumers and banks billions of dollars each year, it is vital that you find ways to protect yourself from falling victim to a criminal who wants to steal your money. If you do write checks, always plan on shredding them if you have them returned to your home. You should shred any of the duplicate checks that come with your checks, as they are an easy way for a criminal to grab your account information. Plan on checking your bank account often so you can track your balance and watch the cleared checks. Immediately report any suspicious activity to your bank so they can put a hold on the account, hopefully preventing a person from getting money. Create a difficult PIN to prevent criminals from guessing it and using it to pull money from your account.

In addition to check forgery, Joseph Stern writes on general criminal law, criminal procedure, theft, white collar crime, bail bonds and other relevant issues. For more info on bail bonds and legal services Joseph encourages readers to visit garzabail.com.

Image credit goes to Jack Spades.

No Comments

Leave a comment Cancel